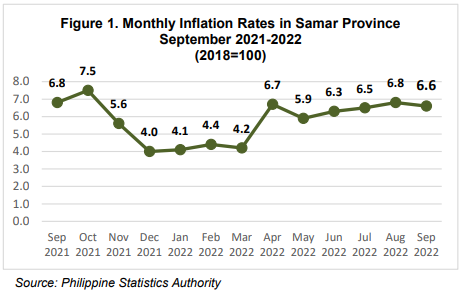

Samar’s Inflation decelerates to 6.6% in September 2022

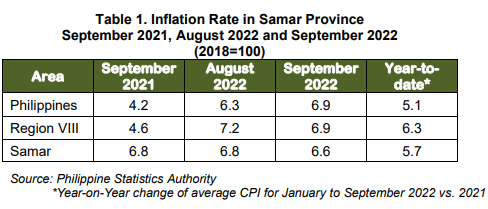

Inflation Rate of Samar Province decelerated from 6.8 percent in August 2022 to 6.6 percent in September 2022 (Figure 1). Moreover, a 0.2-percentage point difference was recorded in the province between September 2021 and 2022. Meanwhile, a provincial year-to-date of 5.7 percent was derived from the average of the inflation rates from January to September 2022. (Table 1)

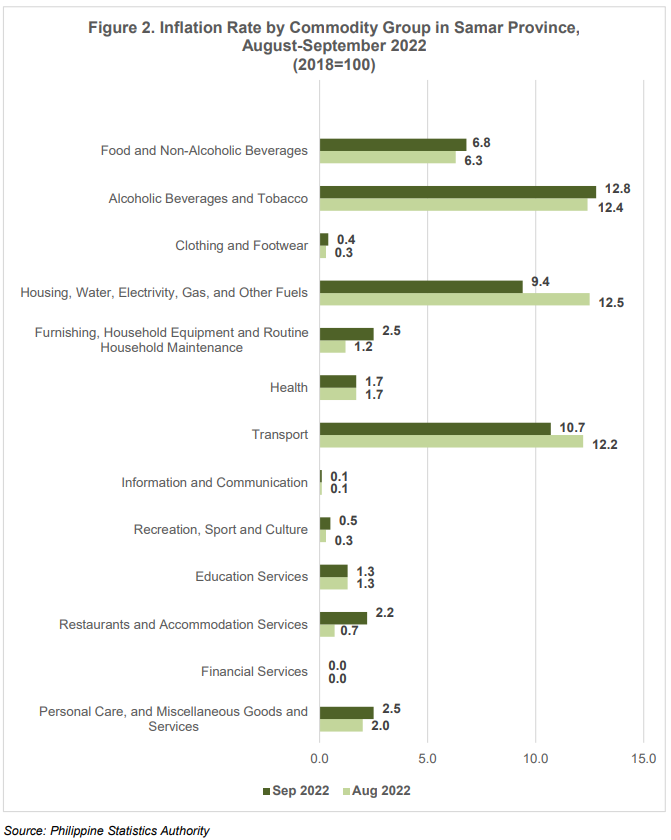

The deceleration in inflation rate was mainly due to the decline in Housing, Water, Electricity, Gas and other Fuels from 12.5 percent in August to 9.4 percent in September; and, Transport from 12.2 percent in August to 10.7 percent in September.

On the contrary, seven out of thirteen commodity groups showed an increase in rates, including: Alcoholic Beverages and Tobacco (12.8%); Food and NonAlcoholic Beverages (6.8%); Furnishings, Household Equipment and Routine Household Maintenance and Personal Care (2.5%); Miscellaneous Goods and Services (2.5%); Restaurants and Accommodation Services (2.2%); Recreation, Sport and Culture (0.5%); and, Clothing and Footwear (0.4%) (Figure 2).

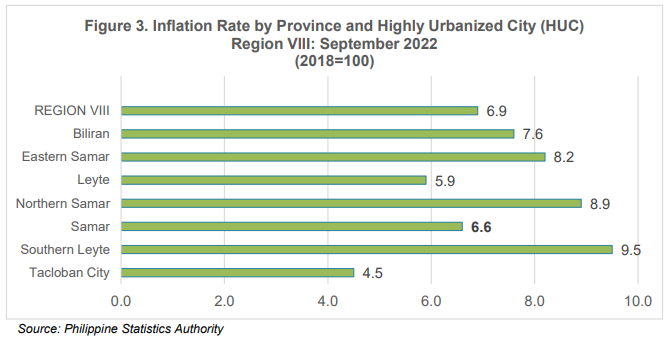

Samar remains fifth highest IR in Eastern Visayas

Samar Province remained fifth with the highest inflation rate among the six provinces and one highly-urbanized city (HUC) in the region. Southern Leyte recorded the highest inflation rate for the same month with 9.5 percent, followed by Northern Samar with 8.9 percent. Tacloban City, the lone HUC in Region VIII, recorded an inflation of 4.5 percen (Figure 3).

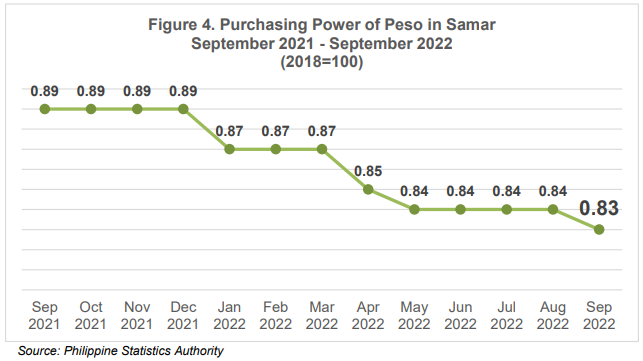

Purchasing Power of Peso for Samar decreases to 0.83 in September

Samar Province’s Purchasing Power of Peso (PPP) decreased to 0.83 after four consecutive months of consistent PPP. This further indicates that the price of the same market basket of goods and services valued at Php 100.00 in 2018 are worth Php83.00 in September 2022 or the value of Php1.00 in 2018 is 0.83 centavos during the month of September this year (Figure 4).

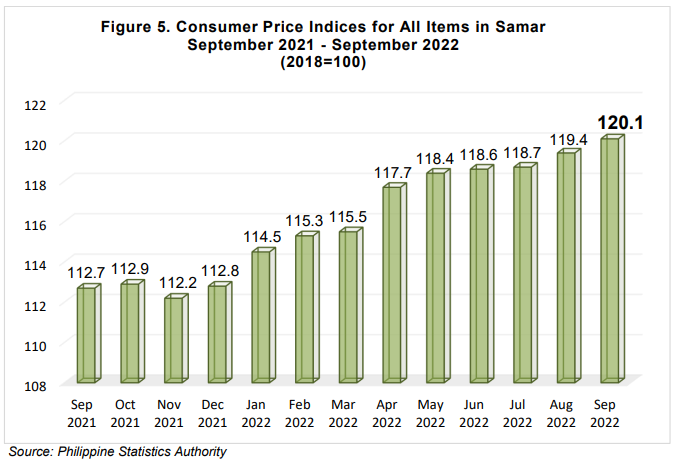

September 2022 CPI for All Items in Samar grows to 120.1

Samar’s Consumer Price Index (CPI) for All Items increased to 120.1, from the previously recorded index of 119.4 in August. This generated a 7.4-point difference from the 112.7 index recorded in the same month of the previous year (Figure 5).

SGD. RIZA N. MORALETA

Chief Statistical Specialist

TECHNICAL NOTES

Consumer Price Index (CPI) - An indicator of the changes in the average retail prices of a fixed market basket of goods and services commonly purchased by households relative to a base year.

Uses of CPI - The CPI is most widely used in the calculation of the inflation rate and purchasing power of peso. It is a major statistical series used for economic analysis and as a monitoring indicator of government economic policy.

Base Period/Year - The reference date or base period is the benchmark or reference date or period at which the index is taken as equal to 100. The current base period is 2018.

Market Basket - A sample of goods and services purchased for consumption availed by the households in the country selected to represent the composite price behavior of all goods and services purchased by consumers.

Weight - A value attached to a commodity or group of commodities to indicate the relative importance of that commodity or group of commodities in the market basket.

Formula - The formula used in computing the CPI is the weighted arithmetic mean of price relatives, the Laspeyre’s formula with a fixed base year period (2018) weights.

Geographic Coverage - CPI values are computed at the national, regional, and provincial levels, and for selected cities.

Inflation Rate - is the rate of change of the CPI expressed in percent. Inflation is interpreted in terms of the declining purchasing power of peso.

Purchasing Power of Peso - shows how much the peso in the base period is worth in the current period. It is computed as the reciprocal of the CPI for the period under review multiplied by 100.

SGD. RIZA N. MORALETA

Chief Statistical Specialist