Leyte’s inflation rate accelerates at 3.9 percent in June 2024

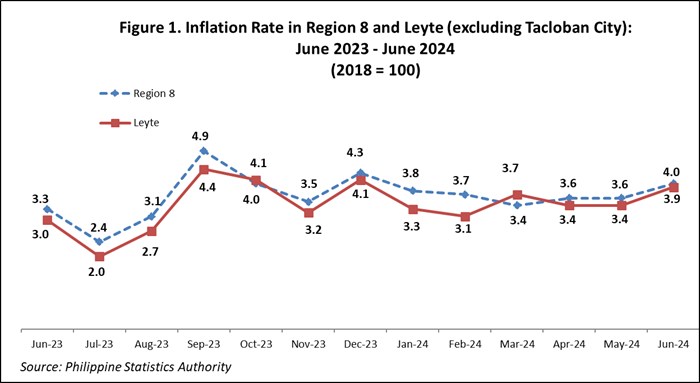

Leyte’s inflation rate increased at 3.9 percent in June 2024 from 3.4 percent in May 2024. In June 2023, inflation rate was lower at 3.0 percent. Likewise, the region’s inflation rate increased at 4.0 percent in June 2024 from 3.6 percent in May 2024. Among the provinces and HUC in Eastern Visayas, only Eastern Samar manifested a decrease in its inflation rate for the reference month.

Main Drivers Contributing to the Upward Trend of Leyte’s Inflation

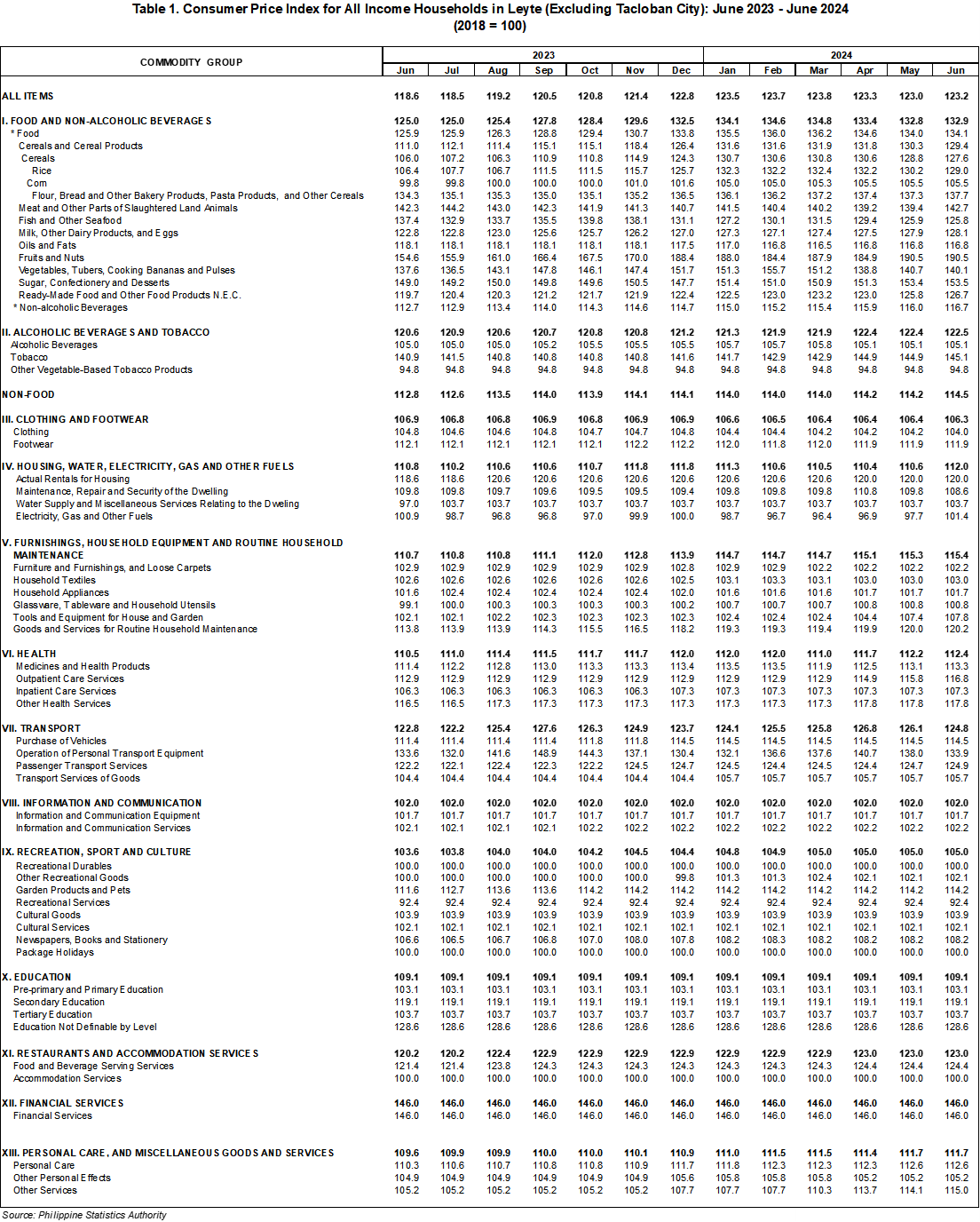

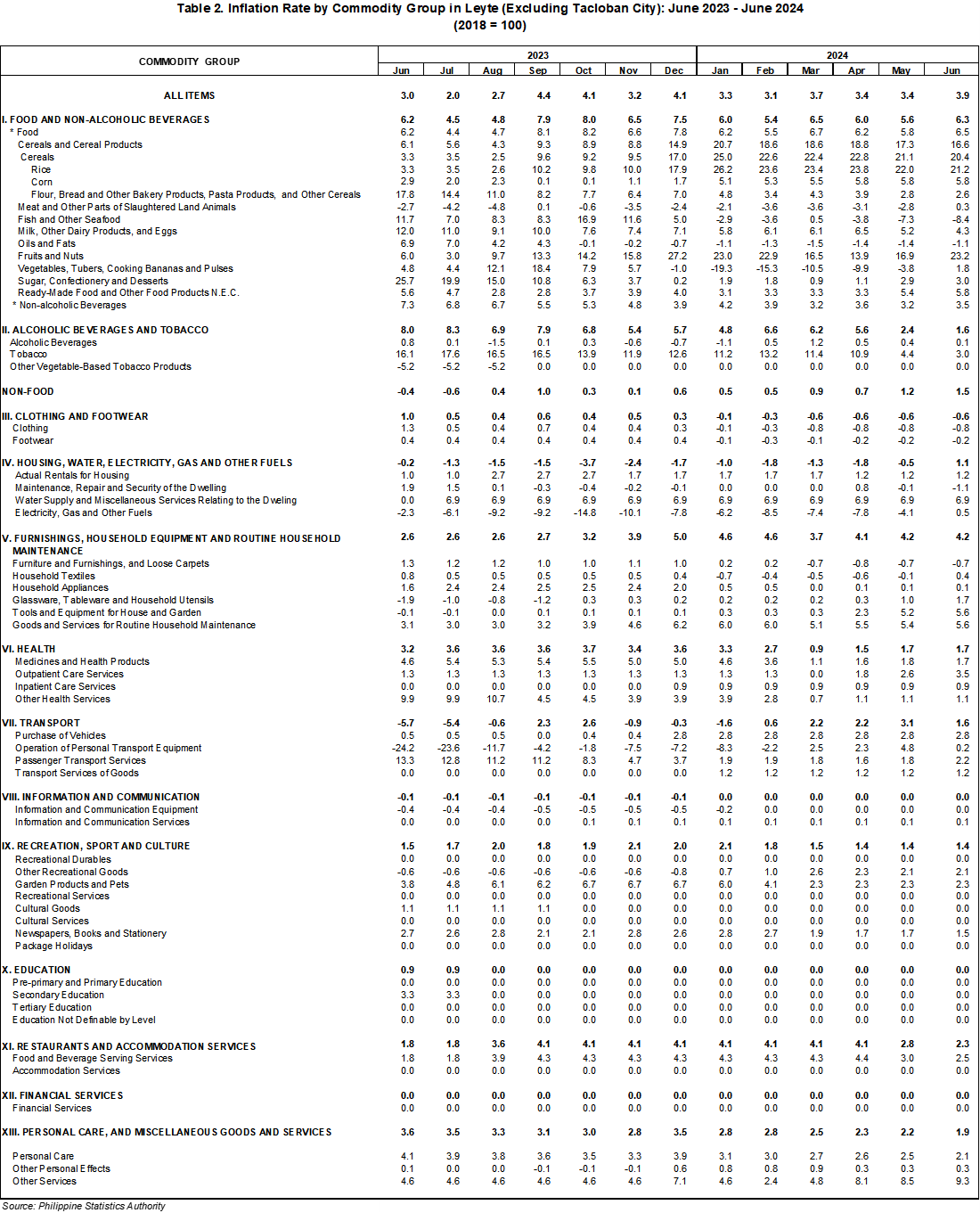

The uptrend in Leyte’s inflation in June 2024 was primarily brought about by the faster annual increment of food and non-alcoholic beverages at 6.3 percent from 5.6 percent in the previous month which was driven by the faster rate of increase in prices of fruits and nuts, sugar, confectionery and desserts, ready-made food and other food products, fruit and vegetable juices, coffee and coffee substitutes, cocoa drinks, water, and soft drinks, the increase in prices of meat and vegetables, tubers, plantains, cooking bananas and pulses, and the slower rate of decrease in prices of oils and fats. Moreover, housing, water, electricity, gas and other fuels recorded an inflation of 1.1 percent from a deflation of -0.5 percent in the previous month due to the slower rate of decrease in prices of electricity and the faster rate of increase in prices of gas and liquid fuels.

In contrast, four (4) commodity groups recorded a decrease in their respective inflation rates in June 2024:

a. Alcoholic beverages and tobacco at 1.6 percent from 2.4 percent in the previous month which was caused by the slower rate of increase in prices of beer and tobacco;

b. Transport at 1.6 percent from 3.1 percent in the previous month due to the slower rate of increase in prices of fuels and lubricants for personal transport equipment;

c. Restaurants and accommodation services at 2.3 percent from 2.8 percent in the previous month which was driven by the slower rate of increase in prices of restaurants, café and the like; and

d. Personal care, and miscellaneous goods and services at 1.9 percent from 2.2 percent in the previous month caused by the slower rate of increase in prices of other appliances, articles and products for personal care and hairdressing salons and personal grooming establishments.

Meanwhile, the six (6) other major commodity groups maintained their inflation rates from their previous months’ rate:

a. Furnishings, household equipment and routine household maintenance at 4.2 percent;

b. Health at 1.7 percent;

c. Information and communication at zero percent;

d. Education services also at zero percent;

e. Financial services also at zero percent; and

f. Recreation, sport and culture at 1.4 percent.

Further, clothing and footwear maintained a -0.6 percent deflation during the month.

The inflation rate is the general rise in prices over a period. It indicates how fast or how slow price changes over two-time periods. Contrary to common knowledge, low inflation does not necessarily connote that prices are falling instead; it means that prices continue to increase at a slower rate. It is a derived indicator of the Consumer Price Index (CPI).

The CPI is a measure of change in the average retail prices of goods and services commonly purchased by a particular group of people in a specific area. The overall CPI in Leyte for June 2024 was 123.2. This implies that the average retail price of goods and services in Leyte is 23.2 percent higher than the average retail prices in 2018 (base year).

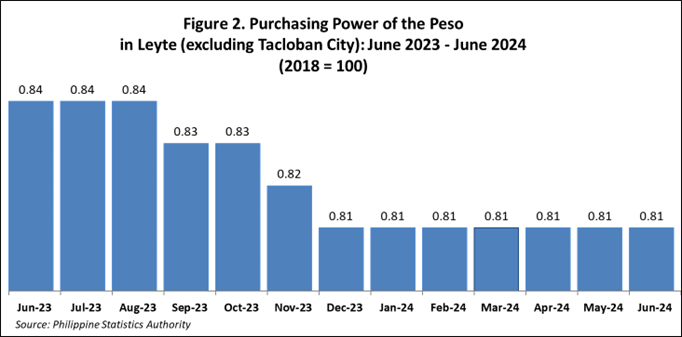

Purchasing Power of Peso (PPP) retains at 81 centavos in June 2024

The Purchasing Power of Peso (PPP) in Leyte retained at 81 centavos in June 2024. Likewise, the PPP in the region retained at 81 centavos in June 2024. The 81 centavos purchasing power of peso in Leyte indicates that the same basket of goods and services worth 81 pesos in 2018 (base year) is worth 100 pesos during the reference period.

TECHNICAL NOTES

Rebasing of the CPI is necessary to ensure that this barometer of economic phenomena is truly reflective of current situation. Consumer taste, fashion and technology change over time causing the fixed market basket of goods and services to become outmoded. To capture such changes for a more meaningful price comparison, revision or updating of the fixed market basket, the sample outlets, the weights and the base year had to be done periodically.

BASE PERIOD – refers to the reference period of the index number. It is a period at which the index is set to 100. Current base period is 2018.

COMPUTING THE CPI - The formula used in computing the CPI is the weighted arithmetic mean of price relatives, a variant of the Laspeyres formula with fixed base year period weights.

CONSUMER PRICE INDEX – is a measure of change in the average retail prices of goods and services commonly purchased by a particular group of people in a particular area.

INFLATION RATE – refers to the annual rate of change or year-on-year change in CPI.

MARKET BASKET - refers to a sample of goods and services used to represent all goods and services bought by a particular group of consumers in a particular area.

MONITORING OF PRICES - is to establish baseline information for prices of the items in the base year and monitoring of the prices of the items on a regular basis. Except for Food, Beverage and Tobacco which is monitored on a weekly basis in NCR, price collection is done twice a month. First collection phase is done during the first five days of the month while the second phase is on the 15th to 17th day of the month.

PURCHASING POWER PESO – it is a measure of how much the peso in the base period is worth in another period. It gives as indication of the real value in a given period relative to the peso value in the base period.

RETAIL PRICE - refers to the actual price at which retailers sell a commodity on spot or earliest delivery, usually in small quantities for consumption and not for resale. It is confined to transactions on cash basis in the free market and excludes black-market prices and prices of commodities that are on sale as in summer sales, anniversary sales, Christmas sales, etc.

WEIGHTS - The weights for the 2018-based CPI were derived from the expenditure data of the 2018 Family Income and Expenditure Survey (FIES). The weight for each item of expenditure is a proportion of that expenditure item to the total national expenditure. The total (all items) national expenditure weights is equal to 100.

SGD. SHERYL ANN A. JAMISOLA

Chief Statistical Specialist