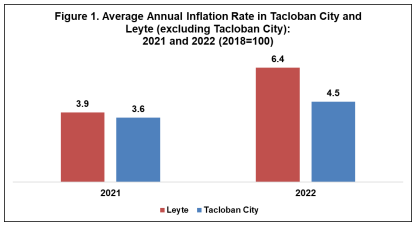

Tacloban City’s 2022 average inflation rate higher than in 2021

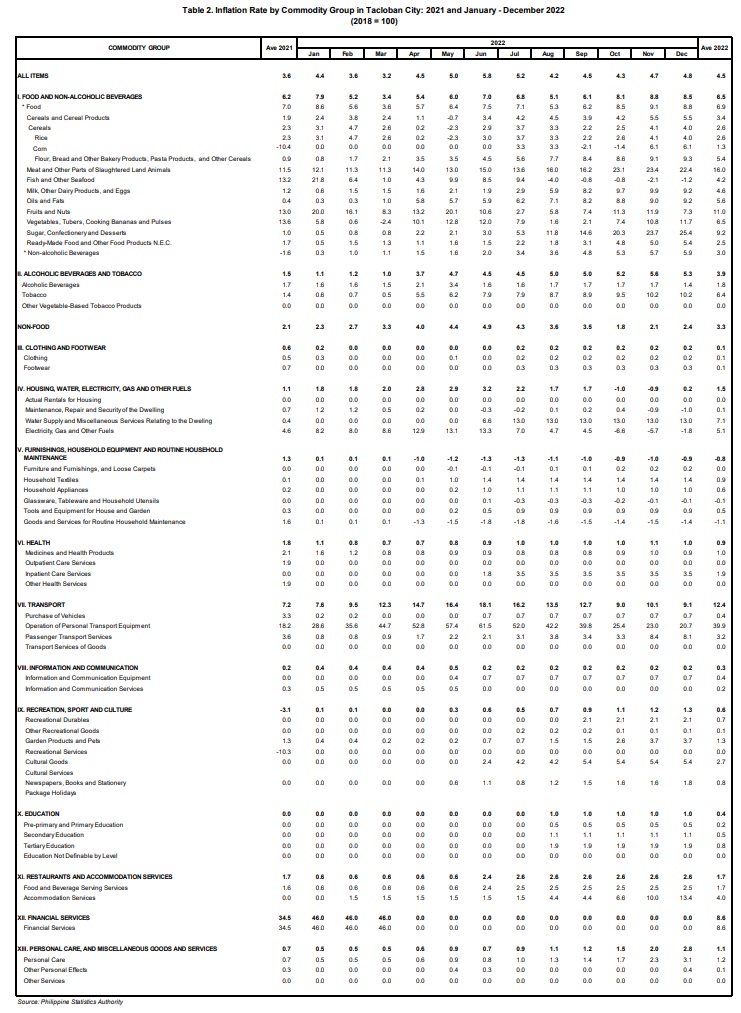

Tacloban City closed the year 2022 with an average of 4.5 percent inflation rate. It was higher by 0.9 percentage point compared to 2021 at 3.6 percent in average. Concurrently, Leyte’s inflation rate in 2022 is relatively higher by 2.5 percentage points, from an average of 3.9 percent in 2021 to 6.4 percent at average in 2022. Among all the provinces and HUC in Eastern Visayas, only the province of Western Samar manifested a lower average inflation rate in 2022 compared to its 2021 average inflation rate.

The 0.9 percentage point difference between two (2) periods was triggered by the increase in the average inflation rates of the eight (8) major commodity groups: Food and Non-alcoholic Beverages at 6.5 percent in 2022 from 6.2 percent in 2021; Alcoholic Beverages and Tobacco at 3.9 percent in 2022 from 1.5 percent in 2021; Housing, Water, Electricity, Gas and Other Fuels at 1.5 percent in 2022 from 1.1 percent in 2021; Transport at 12.4 percent in 2022 from 7.2 percent in 2021; Information and Communication at 0.3 percent in 2022 from 0.2 percent in 2021; Education Services at 0.4 percent in 2022 from 0.0 percent in 2021; Personal Care, and Miscellaneous Goods and Services at 1.1 percent in 2022 from 0.7 percent in 2021; and Recreation, Sport and Culture at 0.6 percent in 2022 from a deflation of 3.1 percent in 2021.

Meanwhile, three (3) major commodity groups exhibited a decline in their average inflation rates from 2021 to 2022: Clothing and Footwear at 0.1 percent in 2022 from 0.6 percent in 2021; Health at 0.9 percent in 2022 from 1.8 percent in 2021; and Financial Services at 8.6 percent in 2022 from 34.5 percent in 2021. In addition, Furnishings, Household Equipment and Routine Household Maintenance recorded an average deflation at 0.8 percent in 2022 from an average inflation rate at 1.3 percent in 2021.

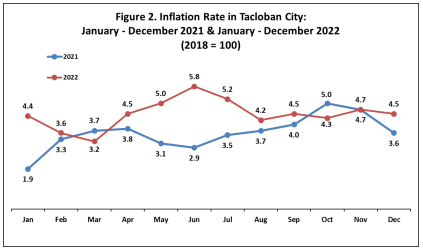

On the other hand, Restaurant and Accommodation Services maintained its average In both years, 2021 and 2022, Financial Services, Transport, and Food and Non-alcoholic Beverages are the top three (3) commodity groups with the highest average inflation rates. In 2021, the highest recorded inflation rate was on the month of October at 5.0 percent. On the other hand, the lowest inflation rate was recorded on the month of January at 1.9 percent. Subsequently, the highest recorded inflation rate in 2022 was recorded on the month of June at 5.8 percent while the lowest registered inflation rate was on the month of March at 3.2 percent.

The inflation rate is the general rise in prices over a period. It indicates how fast or how slow price changes over two-time periods. Contrary to common knowledge, low inflation does not necessarily connote that prices are falling instead, it means that prices continue to increase at a slower rate. It is a derived indicator of the Consumer Price Index (CPI).

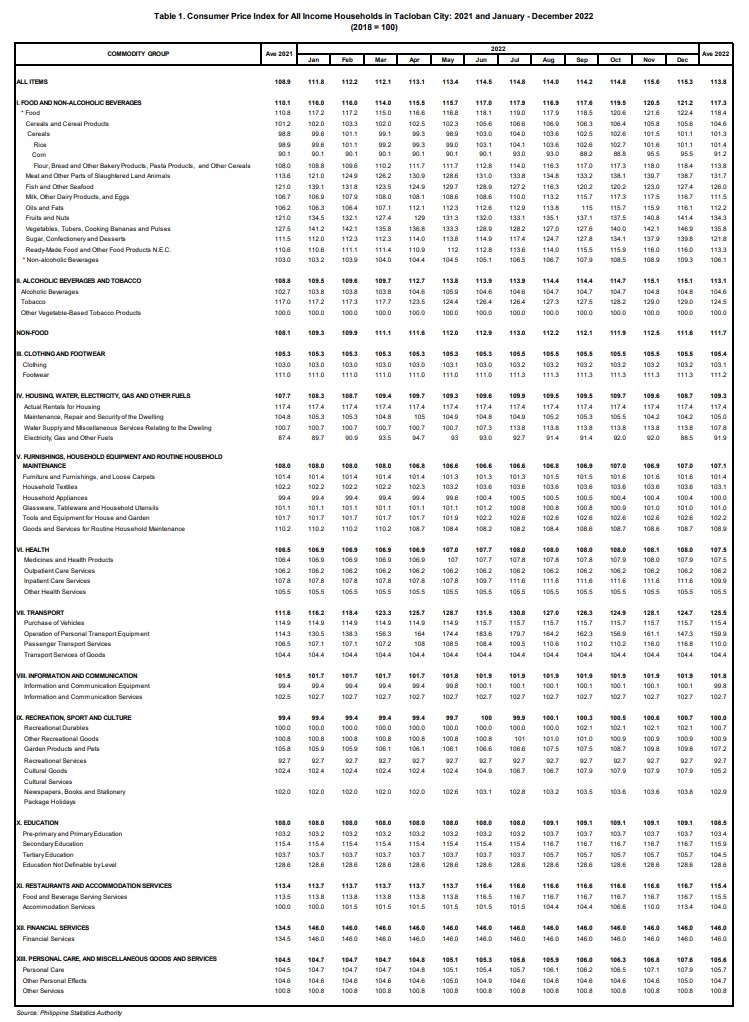

The CPI is a measure of change in the average retail prices of goods and services commonly purchased by a particular group of people in a specific area. The average CPI in Tacloban City for 2022 was 113.8. This implies that the average retail price of goods and services in Leyte is 13.8 percent higher than the average retail prices in 2018 (base year).

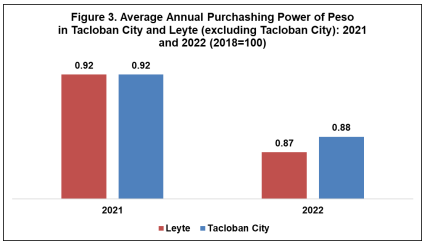

Purchasing Power of Peso (PPP) weakens at 88 centavos in 2022

The Purchasing Power of Peso (PPP) in Tacloban City further diminished by 4 centavos, from 92 centavos in 2021 to 88 centavos in 2022. Furthermore, the PPP in Leyte also decreased its value by 5 centavos, from 92 centavos in 2021 to 87 centavos in 2022. The 88 centavos purchasing power of the peso in Tacloban City indicates that the same basket of goods and services worth 88 pesos in 2018 (base year) is worth 100 pesos in general in 2022.

TECHNICAL NOTES

Rebasing of the CPI is necessary to ensure that this barometer of economic phenomena is truly reflective of current situation. Consumer taste, fashion and technology change over time causing the fixed market basket of goods and services to become outmoded. To capture such changes for a more meaningful price comparison, revision or updating of the fixed market basket, the sample outlets, the weights and the base year had to be done periodically.

BASE PERIOD – refers to the reference period of the index number. It is a period at which the index is set to 100. Current base period is 2012.

MARKET BASKET - refers to a sample of goods and services used to represent all goods and services bought by a particular group of consumers in a particular area.

WEIGHTS - The weights for the 2012-based CPI were derived from the expenditure data of the 2012 Family Income and Expenditure Survey (FIES). The weight for each item of expenditure is a proportion of that expenditure item to the total national expenditure. The total (all items) national expenditure weights is equal to 100.

MONITORING OF PRICES - is to establish baseline information for prices of the items in the base year and monitoring of the prices of the items on a regular basis. Except for Food, Beverage and Tobacco which is monitored on a weekly basis in NCR, price collection is done twice a month. First collection phase is done during the first five days of the month while the second phase is on the 15th to 17th day of the month.

COMPUTING THE CPI - The formula used in computing the CPI is the weighted arithmetic mean of price relatives, a variant of the Laspeyres formula with fixed base year period weights

RETAIL PRICE - refers to the actual price at which retailers sell a commodity on spot or earliest delivery, usually in small quantities for consumption and not for resale. It is confined to transactions on cash basis in the free market and excludes black-market prices and prices of commodities that are on sale as in summer sales, anniversary sales, Christmas sales, etc.

CONSUMER PRICE INDEX – is a measure of change in the average retail prices of goods and services commonly purchased by a particular group of people in a particular area. INFLATION RATE – refers to the annual rate of change or year-on-year change in CPI.

PURCHASING POWER PESO – it is a measure of how much the peso in the base period is worth in another period. It gives as indication of the real value in a given period relative to the peso value in the base period.

SGD. SHERYL ANN A JAMISOLA

Chief Statistical Specialist