Eastern Visayas

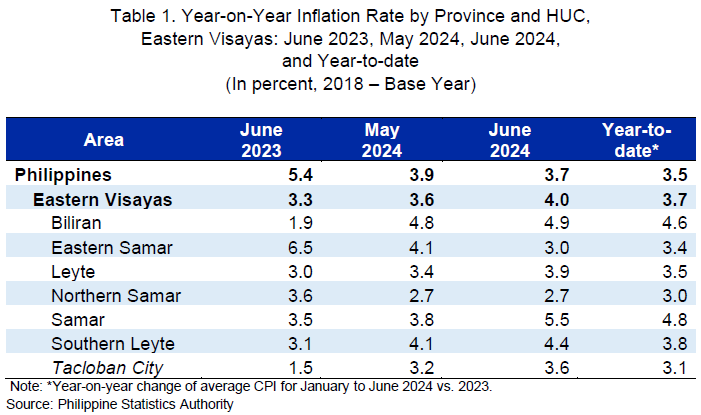

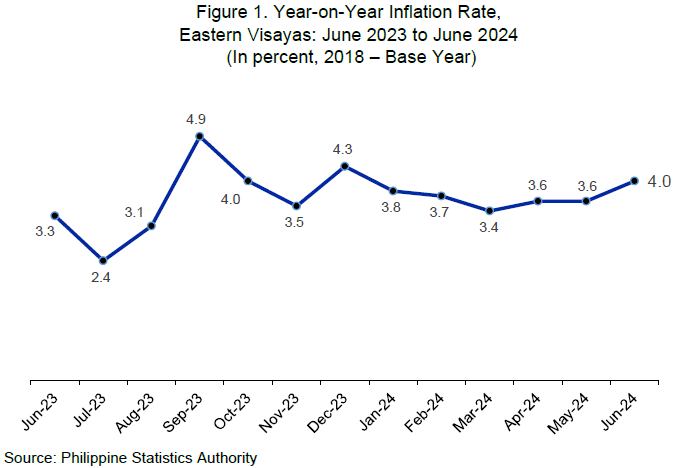

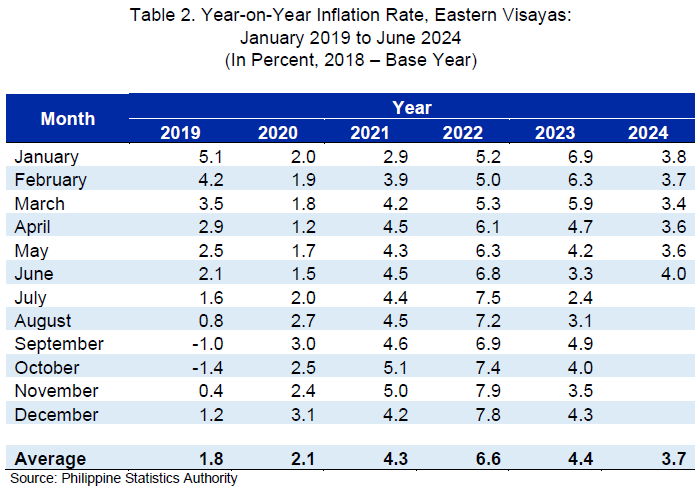

The Inflation Rate (IR) in Eastern Visayas increased to 4.0 percent in June 2024 from 3.6 percent in May 2024. This brings the region’s average IR from January to June 2024 to 3.7 percent. Moreover, the regional IR was higher than the 3.7 percent national IR in June 2024. Compared to June 2024, the regional IR in June 2023 was lower at 3.3 percent (Table 1).

Main Drivers to the Upward Trend of the Regional Inflation

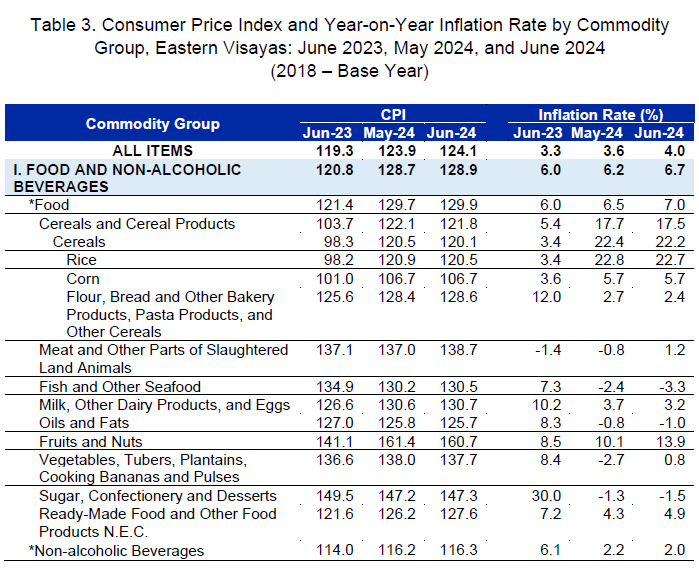

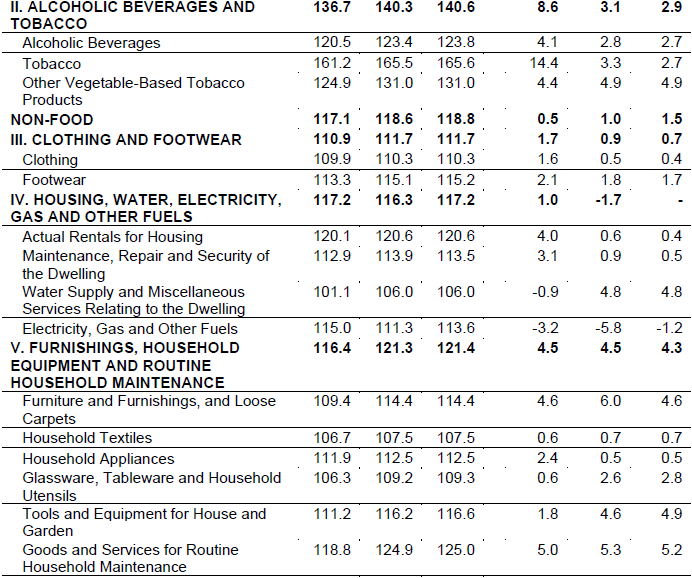

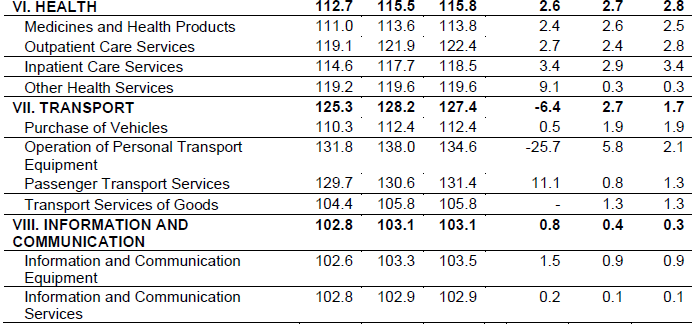

The uptrend in the regional IR in June 2024 was primarily influenced by the upward movement of the index of housing, water, electricity, gas, and other fuels. It registered zero IR in June 2024 from an annual price decrease of 1.7 percent in May 2024. Higher IR in the heavily weighted food and non-alcoholic beverages at 6.7 percent during the month from 6.2 percent in May 2024 also contributed to the uptrend of the regional IR. In addition, the index for health exhibited faster IR at 2.8 percent in June 2024 from 2.7 percent in May 2024.

In contrast, the following commodity groups registered lower IRs during the month:

a. Alcoholic beverages and tobacco, 2.9 percent from 3.1 percent;

b. Clothing and footwear, 0.7 percent from 0.9 percent;

c. Furnishings, household equipment and routine household maintenance, 4.3 percent from 4.5 percent;

d. Transport, 1.7 percent from 2.7 percent;

e. Information and communication, 0.3 percent from 0.4 percent; and

f. Personal care and miscellaneous goods and services, 2.1 percent from 2.5 percent.

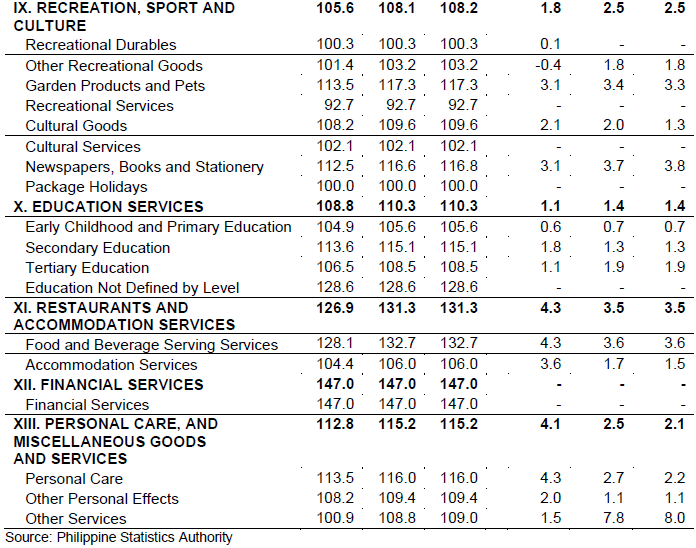

The indices for recreation, sport, and culture; education services; and restaurants and accommodation services retained their previous month’s IRs at 2.5 percent, 1.4 percent, and 3.5 percent, respectively. Meanwhile, IR for financial services remained at zero percent during the month (Table 3).

Main Contributors to the Regional Inflation

The top three commodity groups that contributed to the June 2024 regional IR were the following:

a. Food and non – alcoholic beverages with 80.4 percent share or 3.22 percentage points;

b. Restaurants and accommodation services with 4.2 percent share or 0.17 percentage point; and

c. Furnishings, household equipment, and routine household maintenance, with 3.8 percent share or 0.15 percentage point.

Food Inflation

The IR for food index increased to 7.0 percent in June 2024, from 6.5 percent in May 2024. The IR for food in June 2023 was lower at 6.0 percent (Table 3).

The increase of the IR for food in June 2024 was primarily influenced by the IR in meat and other parts of slaughtered land animals at 1.2 percent during the month from an annual price decrease of 0.8 percent in May 2024. This was followed by vegetables, tubers, plantains, cooking bananas and pulses with an IR at 0.8 percent in June 2024 from an annual price decrease of 2.7 percent in the previous month. Fruits and nuts also contributed to the uptrend with faster IR at 13.9 percent during the month from 10.1 percent IR in May 2024. In addition, ready-made food and other food products not elsewhere classified also recorded faster IR in June 2024 at 4.9 percent from 4.3 percent in May 2024.

On the other hand, compared with their previous month’s IRs, lower IRs were observed in the following food groups:

a. Rice, 22.7 percent from 22.8 percent;

b. Flour, bread and other bakery products, pasta products, and other cereals, 2.4 percent from 2.7 percent;

c. Milk, other dairy products and eggs, 3.2 percent from 3.7 percent;

In addition, fish and other seafood and oils and fats registered faster price decrease in June 2024 at 3.3 percent and 1.0 percent from an annual price decline of 2.4 percent and 0.8 percent, respectively, in May 2024.

Meanwhile, corn retained its previous month’s IR at 5.7 percent.

Main Contributors to the Food Inflation

Food inflation shared 78.6 percent or 3.14 percentage points to the overall inflation in June 2024. The food groups with the highest contribution to the food inflation during the month were the following:

a. Cereals and cereal products, which includes rice, corn, flour, bread and other bakery products, pasta products, and other cereals, with 92.6 percent share or 6.5 percentage points;

b. Fruits and nuts, with 6.8 percent share or 0.5 percentage point; and

c. Milk, other dairy products and eggs with 2.9 percent share or 0.2 percentage point.

Inflation Rate by Region

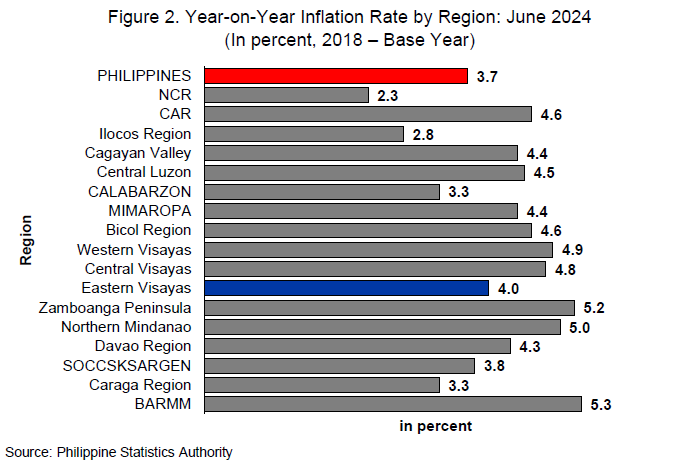

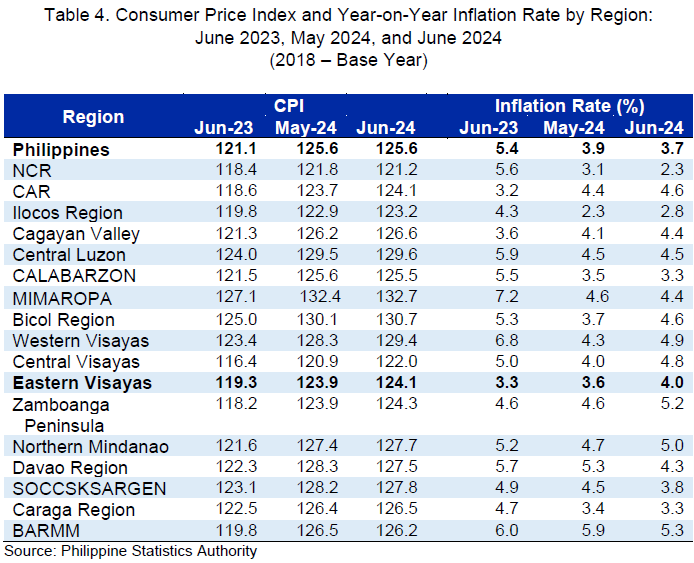

Nine (9) regions recorded higher IRs in June 2024, seven (7) regions had lower IRs, while the remaining one (1) region moved the same as in the previous month compared with their respective IRs in May 2024. Eastern Visayas’ IR at 4.0 percent ranked fifth among the regions with low IRs during the month in review. BARMM recorded the highest IR at 5.3 percent, while NCR registered the lowest IR at 2.3 percent (Figure 2 and Table 4).

Inflation Rate by Province

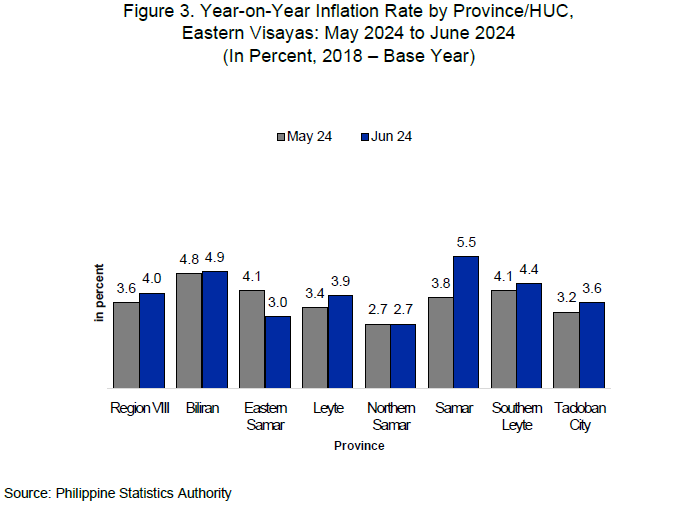

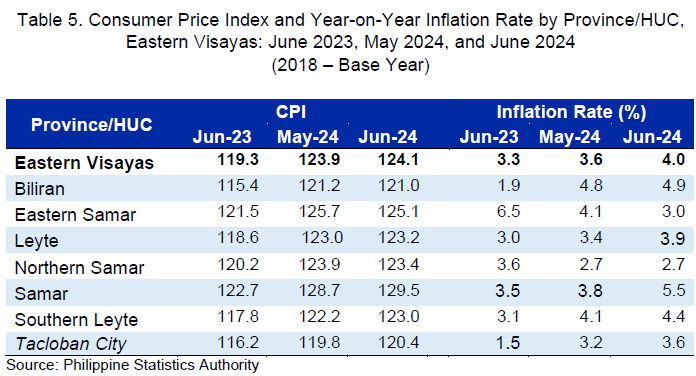

Relative to their IRs in May 2024, the Highly Urbanized City of Tacloban and four (4) provinces, namely Biliran, Leyte, Samar, and Southern Leyte recorded higher IRs in June 2024. On the other hand, Eastern Samar registered lower IR, while Northern Samar retained its previous month’s IR. Among the provinces, Samar posted the highest IR at 5.5 percent in June 2024. Biliran’s IR came next at 4.9 percent, followed by Southern Leyte at 4.4 percent, Leyte at 3.9 percent, and Eastern Samar at 3.0 percent. The lowest IR among the provinces was recorded in Northern Samar at 2.7 percent (Figure 3 and Table 5).

Meanwhile, IR for Tacloban City was recorded at 3.6 percent in June 2024. (Figure 3 and Table 5).

TECHNICAL NOTES

The current CPI series is 2018-based. The rebasing to 2018 is the 12th base period and 11th rebasing for CPI. The five steps involved in the rebasing/computing of CPI are as follows: (1) identification of the base year (2) determination of the market basket (3) determination of household consumption patterns/weights (4) monitoring of prices of items in the basket and (5) computation of CPI.

The 2018-based CPI series uses the same method of computation as the 2012-based CPI series, which is chained Laspeyres formula.

BASE YEAR - is a period at which the index number is set to 100. It is the reference point of the index number series. The CPI is rebased from 2012 to 2018.

CONSUMER PRICE INDEX (CPI) - is an indicator of the change in the average prices of a fixed basket of goods and services commonly purchased by households relative to a base year.

DEFLATION - is the decline in prices for goods and services that happens when the inflation rate dips below zero percent.

INFLATION RATE (IR) - is the annual rate of change or the year-on-year changes in CPI. It indicates how fast or how slow price changes over two time periods (year-on-year). Contrary to common knowledge, low inflation does not necessarily connote that prices of commodities are falling. It means that prices continue to increase but at a slower rate.

MARKET BASKET - refers to a sample of goods and services commonly purchased by the households. The market basket for CPI was updated using the results of the 2021 Survey of Key Informants (SKI). The commodities included in the 2018-based CPI market basket were the modal commodities which were considered as the most commonly purchased/availed commodities by the households. The commodities in the 2018-based CPI market basket were grouped/classified according to the 2020 Philippine Classification of Individual Consumption According to Purpose (PCOICOP).

MONITORING OF PRICES - involves establishing baseline information for the prices of the items in the base year and monitoring the prices of the items on a regular basis. Data collection for the CPI is done by the provincial office twice a month, except for petroleum products which are monitored on a weekly basis, every Friday. First collection phase is done during the first five days of the month while the second phase is on the 15th to 17th day of the month.

PURCHASING POWER OF PESO (PPP) - gives an indication of the real value of peso (how much it is worth) in a given period relative to its value in the base period. It is computed as the reciprocal of CPI multiplied by 100.

RETAIL PRICE - refers to the actual price at which retailers sell a commodity on spot or earliest delivery, usually in small quantities for consumption and not for resale. It is confined to transactions on cash basis in the free market and excludes underground prices and prices of commodities that are on sale as in summer sales, anniversary sales, Christmas sales, etc.

WEIGHTS - is a value attached to a commodity or group of commodities to indicate the relative importance of that commodity or group of commodities in the market basket. The weights for the 2018-based CPI were derived from the expenditure data of the 2018 Family Income and Expenditure Survey (FIES). The weight for each commodity/group of commodities is the proportion of the expenditure commodity/group of commodities to the total national expenditure. The sum of the weights of the commodity groups at the national level is equal to 100.

(SGD) WILMA A. PERANTE

Regional Director