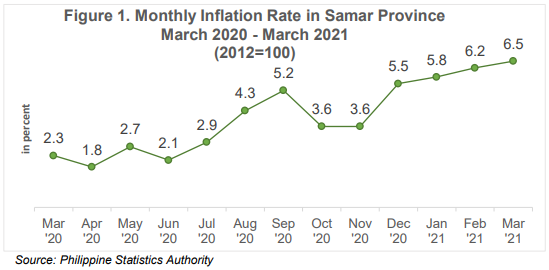

Samar’s inflation rate (IR) accelerated to 6.5 percent in March 2021, from last month’s figure of 6.2 percent. This is 4.2 percentage points higher than the 2.3 percent inflation rate recorded in the same month last year. (See Figure 1)

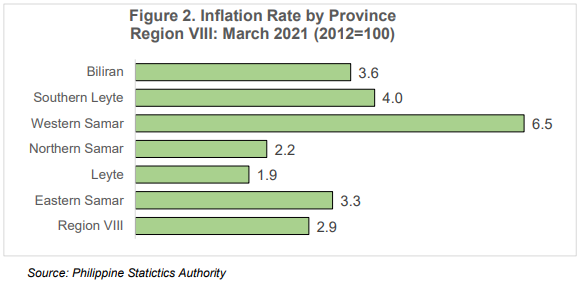

Among provinces, Samar posted the highest inflation rate in March 2021. This was followed by Southern Leyte and Biliran at 4.0 and 3.6 percent, respectively. While Leyte posted the lowest IR at 1.9 percent. (See Figure 2)

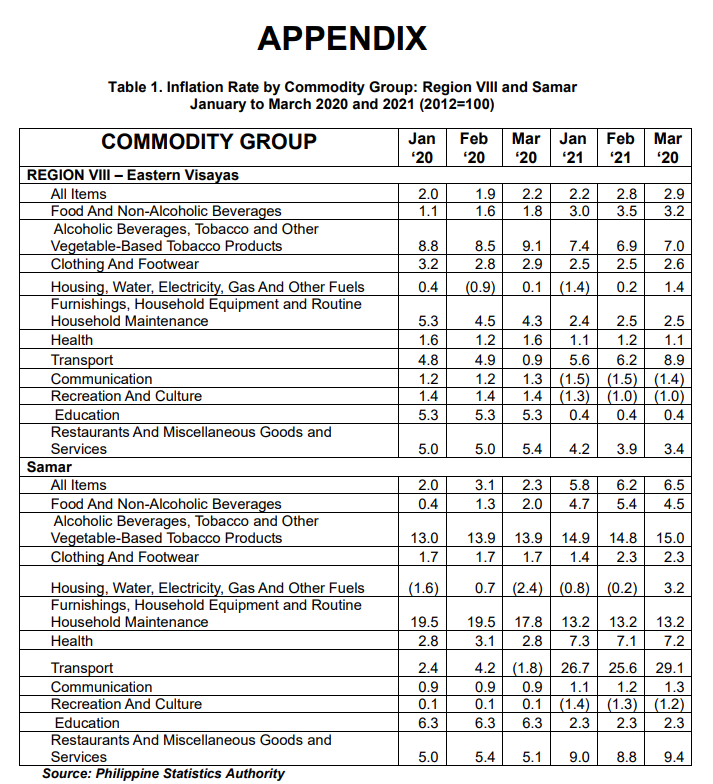

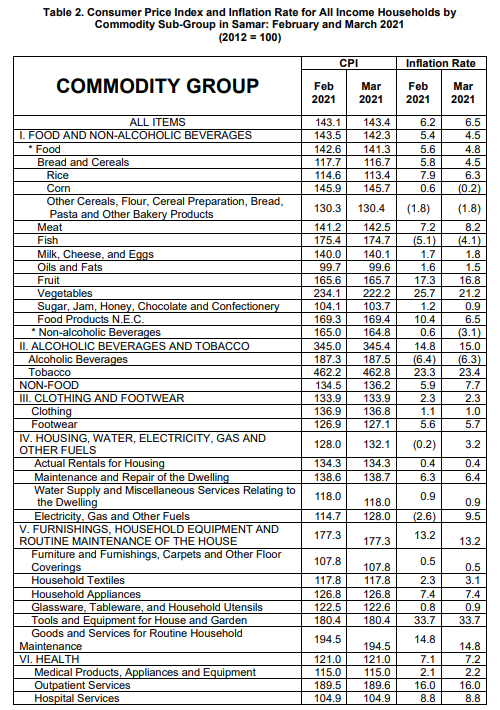

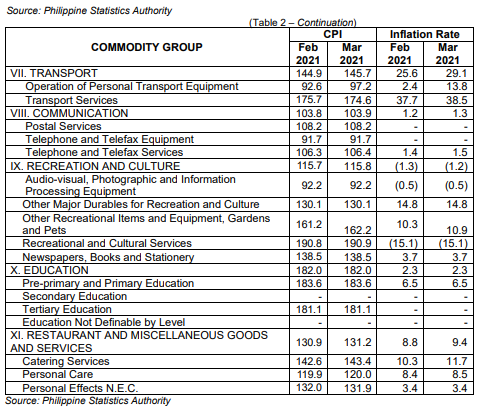

BY COMMODITY GROUP

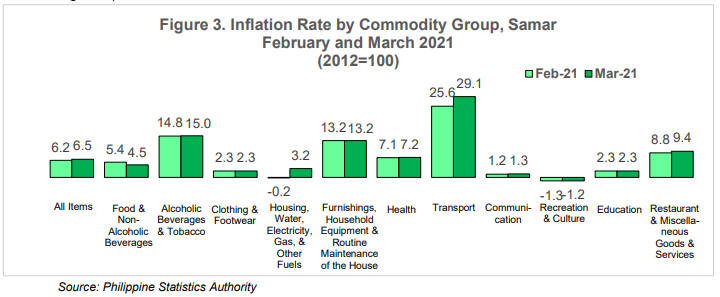

Among eleven commodity groups, seven yielded increases in inflation rate. The Transport group generated the highest increase at 3.5 percent. Other commodity groups include: Housing, Water, Electricity, Gas, & Other Fuels (3.4%); Restaurant and Miscellaneous Goods and Services (0.6%). On the other hand, only Food and Non-alcoholic Beverages commodity group exhibited a decrease of 1.0 percent in March 2021. (See Figure 3)

PURCHASING POWER OF PESO

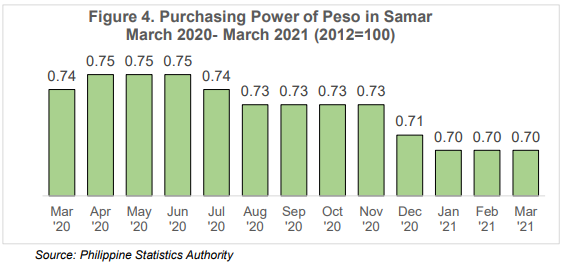

Purchasing Power of Peso (PPP) remained at 0.70 for the 1st Quarter of 2021 indicating that the prices of the same market basket of goods and services worth Php 100.00 in 2012 would cost Php 70.00 in March 2021. (See Figure 4)

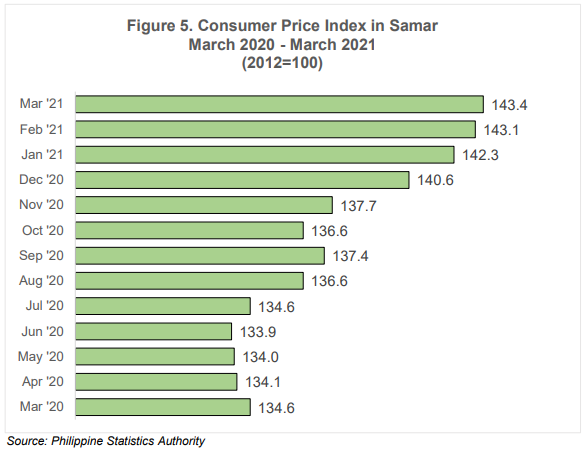

MONTHLY CONSUMER PRICE INDEX

A Consumer Price Index (CPI) of 143.4 was recorded in March 2021 yielding a difference of 0.3 from the CPI generated in February 2021. (See Figure 5)

SGD. RIZA N. MORALETA

Chief Statistical Specialist

TECHNICAL NOTES

Consumer Price Index (CPI) An indicator of the changes in the average retail prices of a fixed market basket of goods and services commonly purchased by households relative to a base year.

Uses of CPI The CPI is most widely used in the calculation of the inflation rate and purchasing power of peso. It is a major statistical series used for economic analysis and as a monitoring indicator of government economic policy.

Base Period/Year The reference date or base period is the benchmark or reference date or period at which the index is taken as equal to 100. The current base period is 2012.

Market Basket A sample of goods and services purchased for consumption availed by the households in the country selected to represent the composite price behavior of all goods and services purchased by consumers.

Weight A value attached to a commodity or group of commodities to indicate the relative importance of that commodity or group of commodities in the market basket.

Formula The formula used in computing the CPI is the weighted arithmetic mean of price relatives, the Laspeyre’s formula with a fixed base year period (2012) weights.

Geographic Coverage CPI values are computed at the national, regional, and provincial levels, and for selected cities.

Inflation Rate is the rate of change of the CPI expressed in percent. Inflation is interpreted in terms of the declining purchasing power of peso.

Headline Inflation refers to the rate of change in the CPI, a measure of the average standard “basket” of goods and services consumed by a typical family.

Purchasing Power of Peso shows how much the peso in the base period is worth in the current period. It is computed as the reciprocal of the CPI for the period under review multiplied by 100.

SGD. RIZA N. MORALETA

Chief Statistical Specialist

Officer-In-Charge